#Parallax volatility advisers tail hedging full#

Compare Standard and Premium Digital here.Īny changes made can be done at any time and will become effective at the end of the trial period, allowing you to retain full access for 4 weeks, even if you downgrade or cancel. performs its advisory services is located at 88 Kearny Street, San Francisco, CA 94108, which is also the mailing address of the firm. Will has been involved with equity options since 1995 and has. Based in San Francisco The principal office where Parallax Volatility Advisers, L.P. Will Bartlett is Parallax Volatility Advisers CEO.

You may also opt to downgrade to Standard Digital, a robust journalistic offering that fulfils many user’s needs. Specialties: Volatility, Correlation, Risk Management, Tail & Overlay Hedging, Liquid Strategies, Investment Management, Derivatives, Multi-Strategy, Alpha. Indirect Owners The SEC currently registers 4 indirect owners.

If you’d like to retain your premium access and save 20%, you can opt to pay annually at the end of the trial. Parallax Volatility Advisers, LP Gestión de inversiones San Francisco, CA 967 seguidores Seguir Ver los 60 empleados Denunciar esta empresa Denunciar. If you do nothing, you will be auto-enrolled in our premium digital monthly subscription plan and retain complete access for $69 per month.įor cost savings, you can change your plan at any time online in the “Settings & Account” section. For a full comparison of Standard and Premium Digital, click here.Ĭhange the plan you will roll onto at any time during your trial by visiting the “Settings & Account” section. Premium Digital includes access to our premier business column, Lex, as well as 15 curated newsletters covering key business themes with original, in-depth reporting. Parallax Volatility Advisers, LP Pamamahala sa Investment San Francisco, CA 943 tagasubaybay Subaybayan Tingnan ang 1 employee I-ulat ang kompanyang ito Iulat Iulat. Standard Digital includes access to a wealth of global news, analysis and expert opinion. 10mos ago Hedge Fund alphacution Views: 85 Off the back of some recent modeling upgrades, Alphacution is finally able to share sample analysis of one of the largest customer accounts in the US equity option market: Parallax Volatility Advisors, LP. This year Dominicé was pleased to contribute to Beanstalk, a charity that raises funds to provide one-to-one literacy support to primary school children.įrom left to right: Kokou Agbo-Bloua (SG CIB), Pierre de Saab (Dominicé & Co.During your trial you will have complete digital access to FT.com with everything in both of our Standard Digital and Premium Digital packages. Volatility Investing events support two outstanding charities: Beanstalk and Woman's Trust. He explained how the current transition to a new volatility regime posed a challenge to well-known passive volatility strategies, making active volatility management more relevant than ever. Pierre de Saab, Partner at Dominicé, shared his views on the panel “In the current environment, should investors prioritize hedging or reduce exposure? Can volatility strategies offer a viable/cost effective solution?” Alongside other prominent volatility managers, Pierre de Saab discussed the causes and implications of the peak in volatility that occurred on February 5 th. discussion on implementation of a tail hedge and. Parallax Volatility Advisers, LP Investment Management San Francisco, CA 900 followers Follow View all 57 employees Report this company Report Report. The largest investments include Spdr S&p 500 Etf Tr and Select Sector Spdr Tr, together worth 772 billion. The event also included a debate by John Snow and Robert Fisk about Geopolitical Volatility. Veja grtis o arquivo Volatility-Trading-Primer-Part-I enviado para a. is an investment fund managing more than 2.89 trillion ran by Easton Chen. Institutional investors, especially endowments, are seeking to protect their portfolio exposures.

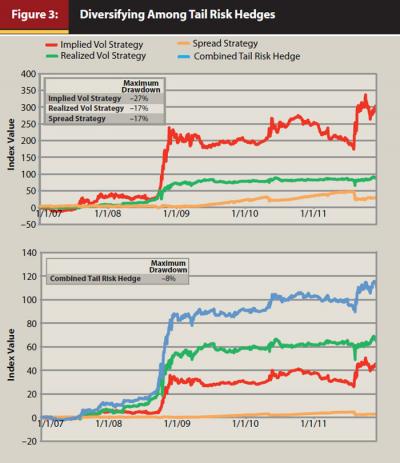

This year’s volatility manager panels was accompanied by dynamic presentations and discussions about volatility in the crypto-currency market, as well as the role of artificial intelligence and big data in today’s investments. Recently, the volatility community has once again seen a massive uptick in tail hedging interest since the end of 2013.

Since 2012, Volatility Investing events have provided a forum for leading volatility managers and institutional investors to share their thoughts on volatility as an asset class. Dominicé participated at the London Volatility and Tail Risk conference on April 12 th 2018 where it shared its views on effective volatility strategies and solutions.

0 kommentar(er)

0 kommentar(er)